All things being equal, there is no reason why an independent Scotland would not work as a more-than moderately successful post-industrial country. It would be better, however, to base this on a plan which appreciates that a currency is not a bank balance or that central banks are unlikely to be encouraged into entering into a currency union with a foreign country on the grounds that “business is business” (if only because central banks are not common businesses) or that declaring the intention to walk away from debts is not the best way to instill confidence in the international market.

It should be remembered by many domestic not to mention outside observers, Fish-heid McMoonface is less a political demi-god than an above-average-but-not-outstanding parliamentarian who has stood over the Lilliputians of the Holyrood Parliament this past decade. A currency union with Ster£ing is both practically and politically implausible, and this appears to be percolating through.

His latest fiat is to assume that an independent Scotland assume observer status on the central monetary committee of the Bank of England: possibly himself drawing on his immense savvy as a professional economist, as seen with his cautioning Sir Fred Goodwin against over-reach in purchasing ABN-Amro. Now, instead of having an input in the setting of monetary policy which for the past three months we have been told was in everyone’s best interests (after years of EWNI being told to mind its own business on anything Scottish), he is pleading to be allowed to watch but not comment.

Other failures to appreciate basic economic concepts come from Business for Scotland which – with its quirky spelling of its name with a Z – grandly announced last September that it had destroyed any notion of the Royal Bank of Scotland or Halifax Bank of Scotland requiring bail-outs from the UK Government.

There used to be the notion that, when a Scottish sports personality succeeded, they were British according to the London-centric, hegemonic neo-liberal media; but when they failed, they reverted to being Scottish. Although not entirely false, it also was prone to hyperbole. Likewise, although somewhat of hyperbole, the notion that during their ascendancy, Scottish-sounding banks such as RBS and HBoS were trumped as examples of Scottish financial acumen and proof of the possibility of self-sufficiency but when they were arse over tits, they became British banks in moral need of bale-outs from HM Treasury.

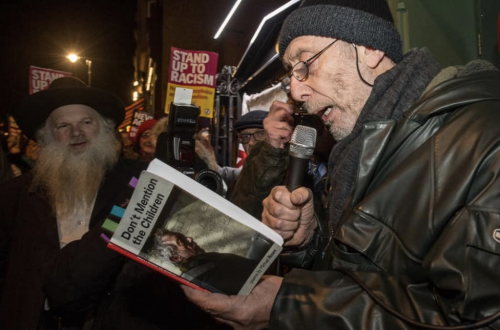

But not Barclay’s Bank PLC according to Gordon MacIntyre-Kemp of #bizforscotland in September 2013. It received a bale-out of some £532 billions from the US Federal Reserve and £6 billions from the Qatari Government. (As recently as March of this year, MacIntyre-Kemp can be seen to have been trying to keep this notion on the front pages, as well as inverting the Scottish/British sports personality trope.)

Well, actually it did not. What it received was a a short-term loan of cash: emphatically not a bail-out which concerns capital-injections to assume responsibility for the un-Christian mess a gaggle of glorified local bank managers had got the economy into.