So can business interests and anti-government types please stop insisting otherwise?

The Center for Effective Government reports:

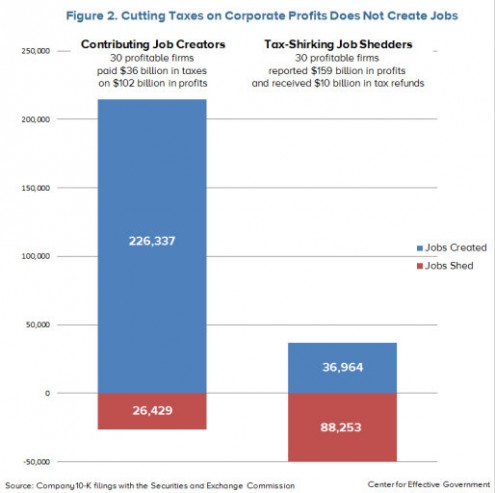

We examined the job creation track record of 60 large, profitable U.S. corporations (from a list of 280 Fortune 500 companies) with the highest and lowest effective tax rates between 2008 and 2010 and found:

• 22 of the 30 corporations that paid the highest tax rates (30 percent or more) on their reported profits created almost 200,000 jobs between 2008 and 2012. Only eight of the 30 firms paying high tax rates reported reducing the number of employees between 2008 and 2012.

• The 30 profitable corporations that paid little or no taxes over three years collectively shed 51,289 jobs; half of these low-tax firms created some jobs, and half shed jobs between 2008 and 2012.

• Lowe’s, the nation’s second-largest home improvement store, paid over 36 percent in taxes on reported profits of $9 billion between 2008 and 2010, and hired an additional 28,820 employees between 2008 and 2012.

• Verizon, the nation’s largest wireless provider, reported $32 billion in U.S. profits between 2008 and 2010, yet received tax refunds totaling $951 million and reduced the number of employees by almost 56,000 between 2008 and 2012.

In fact, based strictly on correlation, one could claim that higher corporate taxes create more jobs. Of course correlation does not equal causation, and I wouldn’t presume to make that argument. But those who believe the opposite have even less reason for doing so.