Since I last cogitated on payday loans, I have modified my position somewhat. Although there still are holes in the ID checking procedures, what has struck me about the vocal opposition is a reflexive distrust of anything which looks like capitalism or simple profit.

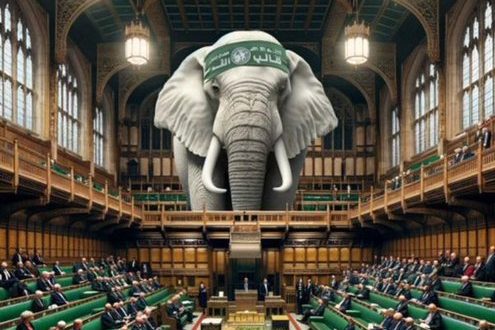

One individual who would have been expected to appreciate the distinction is the Archbishop of Canterbury, Justin Welby. In July, he spoke on the inherently iniquitous nature of loan providers by announcing that his Church would establish its own credit union with the aim of running them into the ground; including specifically Wonga. How he must quickly have wished that such ex cathedra statements from him were considered infallible when it emerged that his Church’s shares portfolio included investments in this very company.

After thenacknowledging the business acumen of Wonga’s chief executive, Welby admitted that whatever the faults of such companies, they were better than loan sharks – which I doubt many would disagree with – but that rapidly increasing loan repayments potentially would force customers into the cold embrace of loan sharks.

This struck me as unfalsifiable because, through all the heat and noise of objections to providers’ combined projected profits for 2013 of some £2.2 billions, it is difficult to determine what proportion of customers fail to repay in the relatively short period of time which such loans are geared for. Similarly, although Wonga’s website quotes an APR of an eye-watering 5,583%, this is a fulfillment of requirements to express repayment details on a per annum basis.

Wonga repayment schedules are between eight and 46 days, with the far end of the scale accruing interest repayments of approximately 50%. If repayments are not completed within 60 days, interest ceases to be applied. The customer’s credit rating is screwed and they are exceedingly unlikely to get another loan from Wonga, but they never will find themselves facing an APR of just knocking 6,000% for an exclusively short-term loan.

Roll forward to today, and Welby has joined Instagram with an opening post reasserting his intention to establish credit unions in every parish. At the same time, Ed Miliband has proposed a tax levy on payday loans which would be channeled into establishing credit unions (the linked piece elides the distinction between formal statements of APR such as 4,000% and the one to two month maximum periods over which interest accrues).

The principle of an industry levy does not appear immediately unmanageable. My main query is whether general taxation could be firewalled for one sole use – although more knowledgeable readers could correct me – and if this proposal bears all the hallmarks of his other proposal to cap domestic energy bills which has achieved early successes.

Also reported are the comments of Alan Milburn, the Government’s social mobility tsar (albeit a tsar without any absolute authority to enforce his remit) that paid employment may no longer be a guarantee of improved conditions. His proposals include scaling-back top-up perks for wealthier pensioners such as free television licenses or bus passes, which I discussed here.

In a situation where stagnating wages and increasing basic costs of living, payday loan providers allow frugal customers instant access to essential funds which can be repaid within a couple of months at interest level which they can absorb. Before the emergence of this regulated industry, such people would have been reliant on loan-sharks who, if they did not repay in time, do more than cancel their credit rating… something which everyone, not just the Archbishop of Canterbury, would object to.