Aesthetically, I find the Wonga-Wonga insta-loan ads more annoying than a troop of Ewoks onboard Babylon-5. At Left Foot Forward, Carl Packham cogitates on a more pernicious aspect: the rise of payday loans, which can turn a debilitating need for a few pounds extra towards the end of the month into an utterly crippling debt of many times that.

As well as the phenomenal rise in the value of the industry – from £100 millions in 2004 to £900 millions in 2009, to a projected £2.2 billions in 2013 – Packham notes the anecdotal evidence from himself and colleagues of the increase in unsolicited e-mails and phone calls promoting such easy-to-obtain loans. Those of us who do not wish to receive such communications must check footnotes on signing-forms, and even then we might be contacted by organizations and groups which, try as we do to wrack our brains, we have no memory of ever dealing with.

Packman observes that such companies are willing to pay up to £60 per head for personal contact details; a disparity of two or three times when compared to other financial services such as mortgages and traditional loans. Clearly, such costs will be offset by profits from high interest rates imposed.

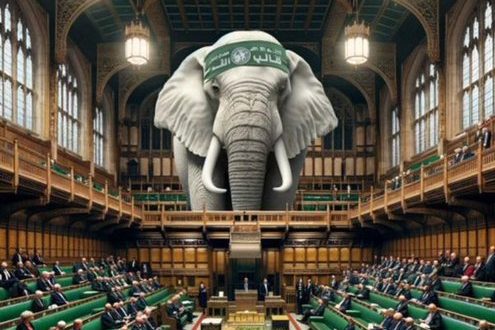

Ed Miliband is displeased, just as he and his senior colleagues have said that betting terminals enjoy unrestricted legislation which allows for overly skewed odds. Fortunately, Harriet Harman has admitted that Labour failed to legislate sufficiently when promoting super casinos as a means to rejuvenate economically depressed areas and, even, actively passed legislation to deregulate high street bookies: so that is alright.