The EU and its antecedent organizations always have struck me as being based on laissez-faire economics and free-trade; which had been concealable during the credit boom when those previously opposed found reasons to involve themselves with its inner sanctum.

Other disparities between stated views and actual actions can be seen in recent economic policy of Cyprus. In addition to having been intertwined with the toxic debt of Greece, she encouraged offshoring from less-than-transparent Russian business interests. With the impending sudden crash of her economy, she has sought EU bail-outs.

To pay for this, the Cypriot Government agree to a one-off levy of 6.75% or 9.9% on savers with under or more than €100,000 respectively.

Whilst I have relatively little sympathy for any surprise that she will need to pay for this bailout and as much as I savour the outrage coming from the Kremlin , I do have sympathy for at least most of the individual proposed victims of this only superficially progressive levy.

It would not extend to assets or foreign-savings, which the independently wealthy are most likely to have their finances sunk in. Instead, it will disproportionately affect the small safer who has, over the course of years or decades, set aside meager cash amounts only to see this gobbled-up. Or a major business in which most of the wealth is tied-up in stocks and shares and property, contrasted to a small to medium business whose ledger follows a peripatetic existence of direct income.

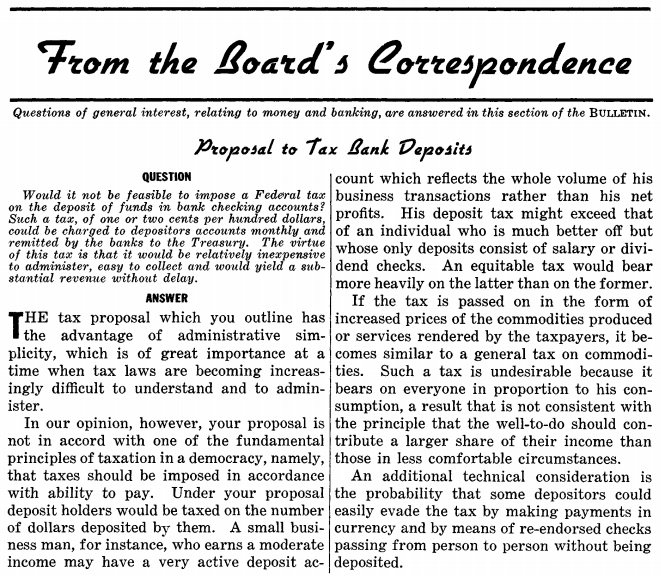

In 1941, as the US emerged from the Great Depression, a similar question was posed. In response, and hat-tip to Edmund Conway of SkyNews who unearthed it, the following similarly dismissive response was issued: